Insurance

In today's uncertain world, the insurance sector stands as a pillar of stability and protection against unexpected events, offering essential financial security and peace of mind to individuals, businesses, and entities. However, companies within the Insurance sector face multiple challenges, including regulatory compliance, evolving customer expectations, technological disruption, and competitive pressures.

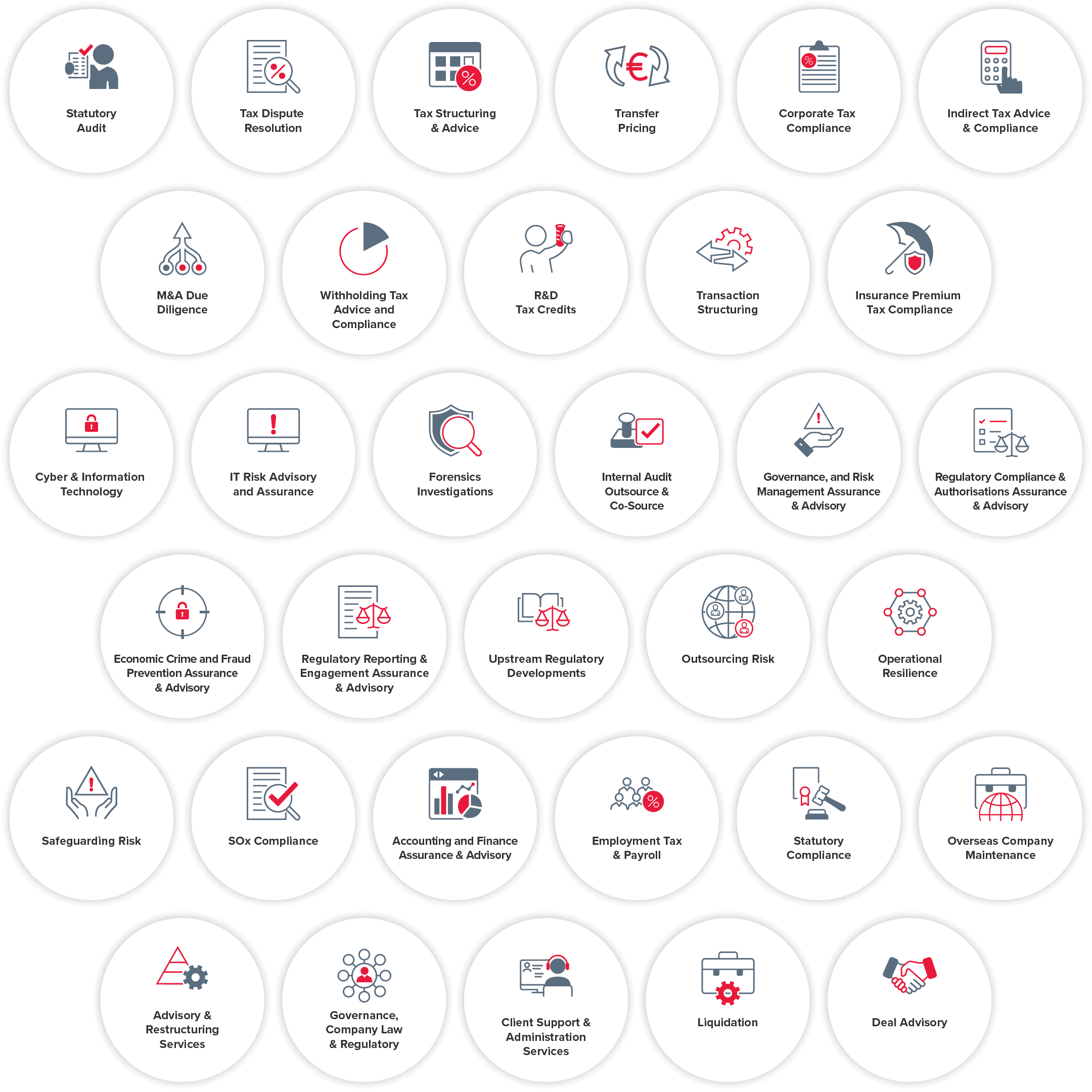

BDO provides comprehensive support to clients in the insurance sector, offering expertise in areas such as regulatory guidance, risk management, internal audit services, and technology advisory. Our services help insurance companies navigate regulatory complexities, optimise operational efficiency, and leverage technology to enhance customer experience and drive innovation. With BDO as a strategic partner, insurance companies can navigate the challenges of the evolving landscape and seize opportunities for growth and differentiation in the market.