Budget 2026

Stay informed with BDO’s comprehensive coverage of Ireland’s Budget 2026.

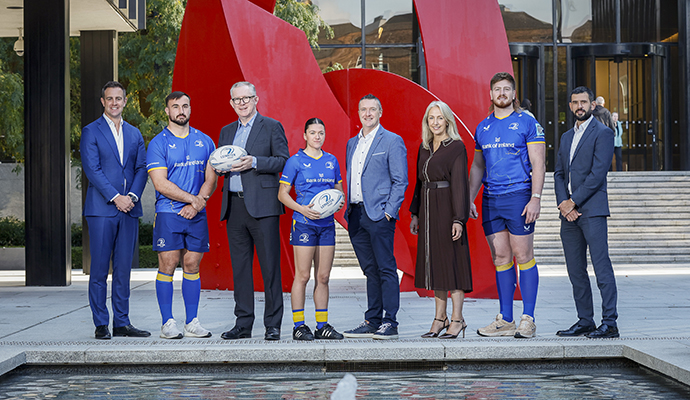

BDO Ireland renews partnership with Leinster Rugby as official business advisors

Cybersecurity Awareness Month 2025

Secure. Confident. Ready

Global Trade Updates

Stay informed of Global Trade changes and their impact on your business

Graduate Programme 2026

Applications now open!

Introducing Executive Search & Advisory at BDO

Finding the right leaders to drive your business forward

Building the finance function of the future

Research by the ACCA and BDO reveals how the role of the CFO is evolving beyond finance, on a journey towards Chief Value Officer. But, what exactly does that mean for your business?

Introducing Entrepreneurial Services

Strategic finance support for scaling founder-led businesses

Global expertise. Local excellence.

BDO Ireland delivers Audit, Tax, Advisory, and Consulting services to Irish and International clients, leveraging the expertise of our BDO Global network.

.jpg)