Ireland is a leading European funds domicile and in February 2021 the commencement order of the Investment Limited Partnership (ILP) was a very welcome development, firmly putting Ireland on the map as a location of choice for a tax transparent fund structure.

The new act has modernised the existing ILP structure, bringing it in line with comparable partnership vehicles in other leading jurisdictions.

The ILP is a regulated common law partnership structure. The Investment Limited Partnership (Amendment) Act 2020 amended the Investment Limited Partnership Act of 1994 which regulated investment limited partnerships in Ireland.

The new ILP falls within the AIFMD regime and offers a suitable structure for private equity, private credit, infrastructure and real asset investment strategies.

Features of the ILP

Available as a regulated retail investor AIF (RIAIF) or as a qualifying investor AIF (QIAIF)

RIAIFs and QIAIFs are capable of being open-ended, limited liquidity or closed-ended in terms of their liquidity profile.

Fast-track Central Bank of Ireland approval process ensuring speed to market

QIAIF ILPs can avail of a fast-track procedure under which the constitutional documents, main offering documents and material contracts are simply filed the day before approval is required. For RIAIF ILPs, the main offering documents are required to be submitted to the Central Bank for prior review and comment.

Marketing Passport

An AIF, which is managed by a manager authorised under AIFMD, can be marketed throughout the EU under the AIFMD marketing passport. No marketing passport is available to a registered AIFM or to a Non-EU AIFM – they can only use national private placement rules, where available.

Formed by a General Partner (GP) and one or more LPs

The ILP is formed pursuant to a Limited Partnership Agreement. The GP can be a natural person or a body corporate. It is possible to have more than one GP. The GP assumes personal liability for the debts and obligations of the IP. The ILP can provide for different categories of LPs to facilitate different returns; carried interest, excused and excluded investors.

There is no limit to the number of LPs

The LP has limited liability status. The 2020 Act provides for a modern “whitelist” of activities which do not compromise the liability status of the LP.

Amendments to the LPA can be made by the GP negating the need for an LP vote

This facilitates amendments to the LPA by allowing alterations to be made:

- In writing via the agreement of a simple majority of partners, provided the existing partnership agreement allows for changes via majority; and/or

- If the depositary certifies that the proposed amendments do not prejudice the interests of the LPs, and certain other requirements are fulfilled.

No need to establish and operate a separate GP for each new structure or category of investor

The ILP can be formed as an umbrella structure with segregated liability between sub-funds allowing different strategies and investors to be serviced from one legal structure.

It is a tax transparent vehicle

Distributions can be made by an ILP to its partners free of any Irish tax implications as all the underlying profits of the ILP shall already have been allocated to the partners for Irish tax purposes. Any underlying income, gains and losses of the ILP shall retain their original characteristic for Irish tax purposes in the hands of any Irish resident partners or any non-Irish resident partners holding their partnership interest in the ILP via an Irish branch, agency or permanent establishment.

Allows for the migration of non-Irish LPs to Ireland

This is done by way of continuation.

Alternative foreign names can be officially recognised

This feature makes it easier for a manager or promoter operating in a non-English speaking country to market a fund established as an ILP.

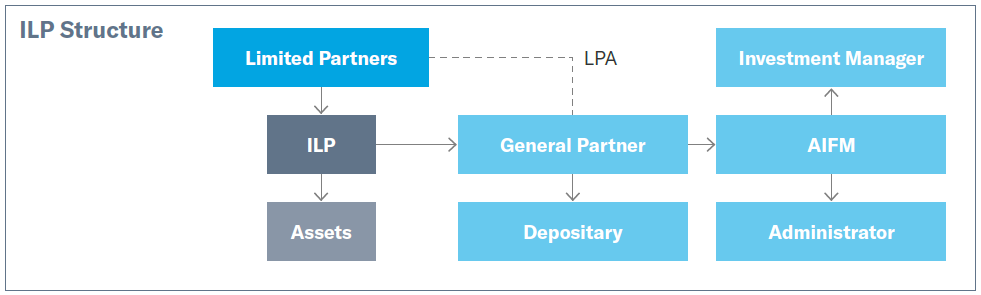

ILP Structure Chart

Conclusion

Following the recent overhaul of the ILP Act, and amendments made to the Central Bank of Ireland’s AIF Rulebook, the Irish ILP is expected to become the fund structure of choice for many investment managers, particularly those in the private equity, private credit, infrastructure and real assets sectors, and those with a longer-term sustainable finance focus.

Ireland is a leading funds domicile. Currently, Irish domicile investment funds manage approximately €3.3 trillion of assets and the industry employs over 16,000 people. The updated ILP adds to the Irish fund product offering, and is expected to make a significant contribution to the further growth of the Irish funds industry. To date, we have seen strong interest from investment mangers in the ILP structure, and we expect this to continue as familiarity with the revised structure grows.

At BDO, we have extensive experience in assisting clients develop efficient investment structures. We have strong working relationships with the leading Irish law firms specialising in asset management, as well as the fund administrators and depositories supporting the Irish fund industry.

For more information on the ILP structure, or how BDO can assist you, please don’t hesitate to contact a member of our Financial Services Team.