Carol Lynch

The Corporate Sustainability Directive (‘CSRD’) entered into force in January 2023 and becomes effective for many companies in 2024. Non-EU businesses now have to determine if they fall under the CSRD’s scope, and which set of the related European Sustainability Reporting Standards (ESRS) apply.

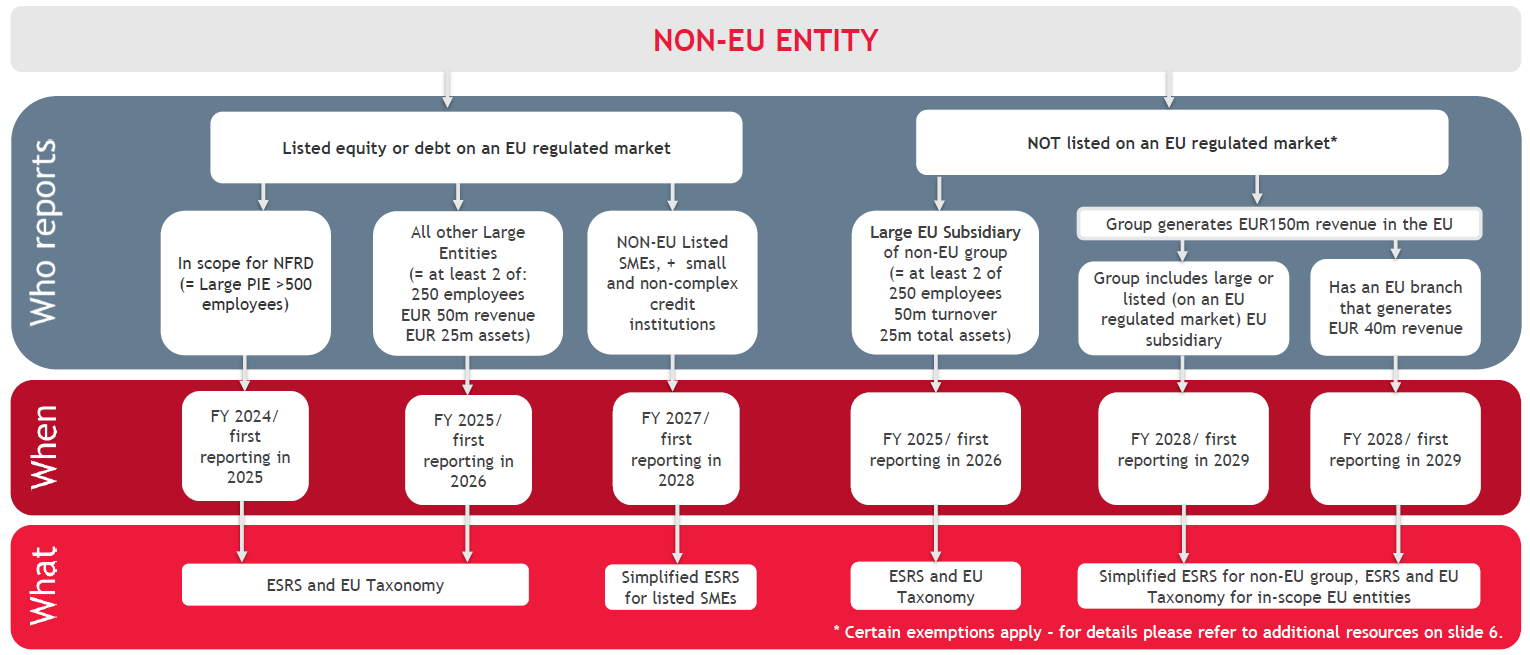

The CSRD has vastly extended the scope of sustainability reporting to include non-EU companies with a listed equity or debt on an EU regulated market and, in certain cases, non-EU companies not listed on an EU regulated market.

Subsidiaries with a non-EU holding company may also have to report under the CSRD, which will have a considerate impact on the holding company. For example, if an Irish subsidiary with a holding company outside the EU is required to report under the CSRD, the non-EU holding company will also have to report. The subsidiary and the holding company can prepare a consolidated report which will need to be disclosed by 2026, or the holding company can choose to report separately by 2029 with the subsidiary reporting by 2026.

The effect of this directive is far-reaching, and it is imperative that non-EU companies start their CSRD journey now to ensure they understand their reporting obligations and are prepared to make the necessary disclosures.

Please see our below graph to determine who needs to report, when they need to report, and what standards they need to follow.