To recap briefly, the main features of the AE scheme (to be known as ‘My Future Fund’) include:

- ‘Eligible Employees’ i.e. those aged between 23 and 60, who are not currently in a workplace pension scheme, and who earn between €20,000 and €80,000 per annum will be automatically enrolled in the scheme.

- ‘Soft mandatory enrolment’ means that all eligible employees will be mandatorily enrolled, but with the facility to opt out within certain time limits (subject to mandatory re-enrolment after two years).

- Employees under aged 23 or over aged 60 can voluntarily elect to be enrolled.

- Employer and employee contributions will initially be set at the rate of 1.5% of earnings yearly, rising gradually to 6% over the next 10 years. The state contribution will be set at 0.5%, rising to 2% after 10 years.

- The scheme will be administered by the National Automatic Enrolment Retirement Savings Authority (‘NAERSA’).

Operating the Scheme

The Department of Social Protection, which has statutory responsibility for the scheme, has stated that one of the fundamental operating principles of AE is that employer administration will be kept to a minimum.

The primary task that employers will need to undertake before the scheme launches on 1 January next is to register with NAERSA through using the Revenue Online System. This facility will be available from early December. Registration is a once off task and applies to the business rather than to its individual employees. On registering, the employer will specify how contributions will be paid over. This can be by direct debit or card payment.

Employers will not be responsible for identifying and registering eligible employees. This task will be carried out by NAERSA using payroll information supplied to it by the Revenue Commissioners.

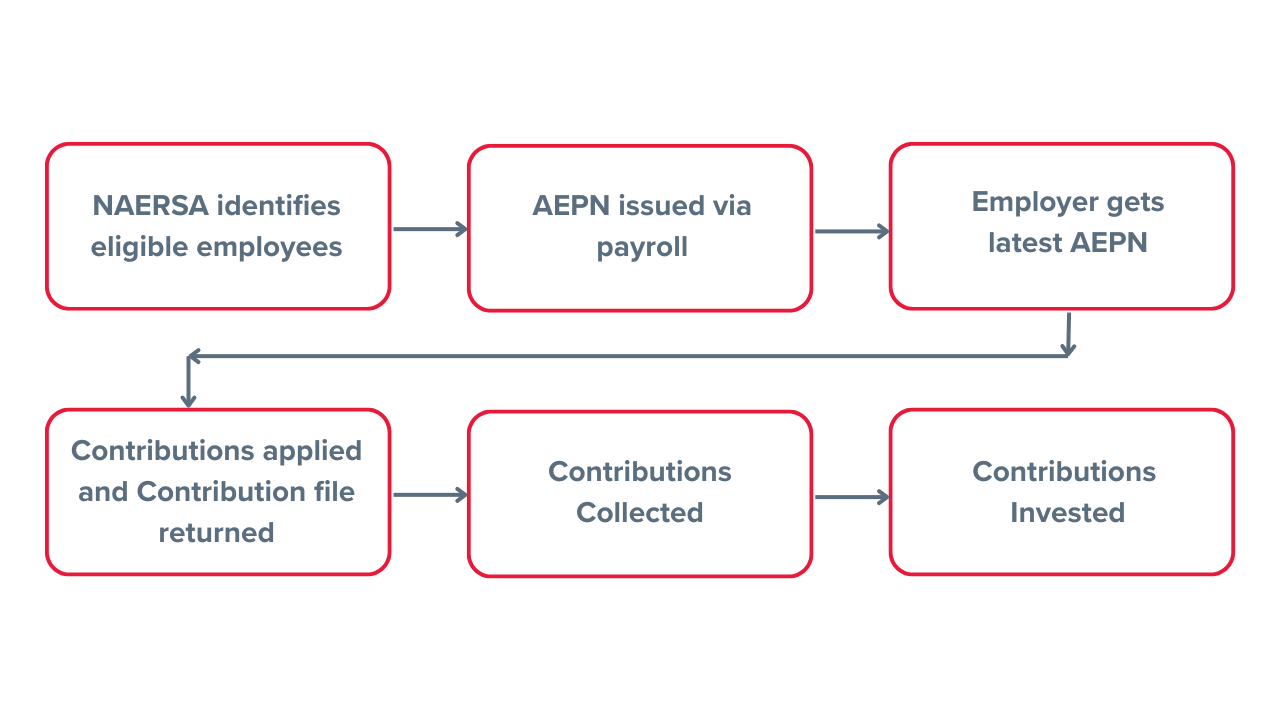

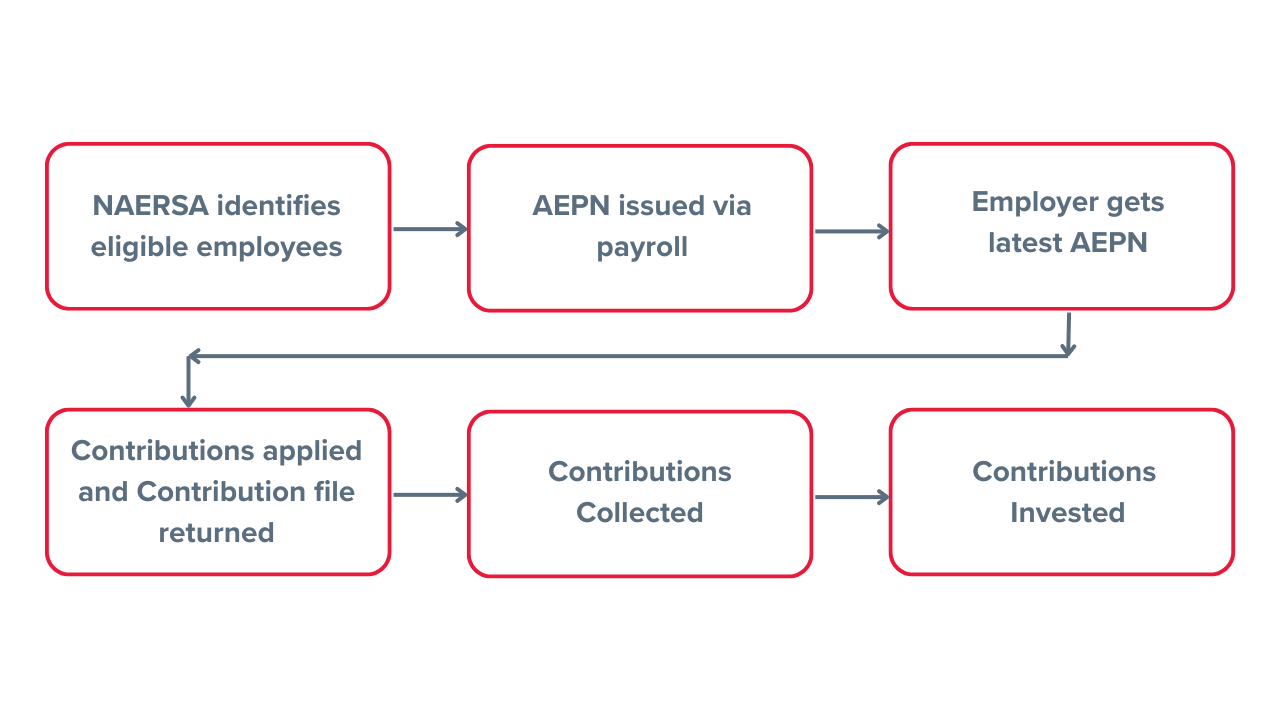

Once an employee has been identified as eligible and enrolled in the scheme, NAERSA will issue a notification to the employer (known as an ‘Automatic Enrolment Payroll Notification’ or AEPN), which will also state the rate of contribution to be paid. This process and any subsequent notifications from NAERSA will be embedded in payroll software, in much the same way that PAYE now operates. At each pay run, the system will poll for any new AEPNs and apply the updated instruction. A contribution file will be generated and submitted to NAERSA before 18:30 on the pay date. Employer and employee contributions will then be collected and paid over to NAERSA.

While Revenue will have some involvement (primarily providing payroll data and collecting the contributions), the scheme will be operated by NAERSA, who will operate employer and employee portals through which employers and scheme members will interact with it. This includes matters such as uploading contribution files and, in the case of employees, opt ins and opt outs.

Overview of the AE Process

Interaction with PAYE System

AE will rely on the PAYE system to identify eligible employees. Employees paying any combination of PRSI classes A, B, C, D, H & J (and relevant sub-classes) will be assessed for eligibility by NAERSA. Those paying PRSI at any other classes will not be considered. Those employees whose Revenue record indicates that they are members of a pension scheme will be automatically excluded from consideration. However, this will only happen if the employee’s pension contributions are made through payroll. If an employee is, for example, contributing to a Personal Retirement Savings Account (PRSA) and paying premiums directly to the insurer, they will still be auto enrolled.

International Assignees

Particular issues may arise in the case of international assignees sent to work in Ireland, as well as for Irish employees sent to work abroad, and who remain on Irish payroll.

In all cases eligibility will be determined by reference to the Irish PAYE data. If a foreign assignee meets the eligibility criteria based on their earnings per the Irish PAYE system, then they will be enrolled, regardless of whether they are already members of a workplace pension scheme in their home country. Conversely, an assignee who remains on a foreign payroll and is not subject to PAYE, will not be enrolled, since NAERSA will not have access to their payroll data.

Irish employees sent to work abroad, who remain on Irish payroll and who are issued with a PAYE Exclusion Order (PEO) exempting then from PAYE, will not be considered for enrolment, since Revenue will not have payroll data for such employees.

Many inbound assignees are however exempted from PRSI under EU regulations or international agreements. They are recorded at PRSI class M. As a result, such assignees will not be considered for enrolment. In all other cases, where PRSI exemption does not apply, employers will need to factor the possibility that assignees may be subject to AE into their assignment policies and may need to consider alternative strategies to manage the issues that arise from this.

Next Steps

Although employers will not be responsible for registering employees in AE, it would be prudent to establish whether and to what extent the business may have employees who will be liable for enrolment. This will enable the business to forecast any additional costs that may arise.

Businesses may also wish to consider whether all employees should be included in any existing pension scheme to avoid having to manage both AE and an occupational scheme simultaneously. Where an initial waiting period applies before employees become eligible to join an occupational scheme, consideration might be given to waiving such periods in order to avoid such employees being enrolled in AE.

The employer registration facility is not yet available. The DSP and NAERSA will publish notices before this is launched, which is expected to occur in early December. Once this happens companies will need to complete the registration process and begin operating AE from 1 January 2026.

Further resources, which set out the business payroll processes in more detail are available from the NAERSA webpage at https://helpcentre.myfuturefund-nonprod.ie/ under ‘Technical Guides’.