Mark O'Sullivan

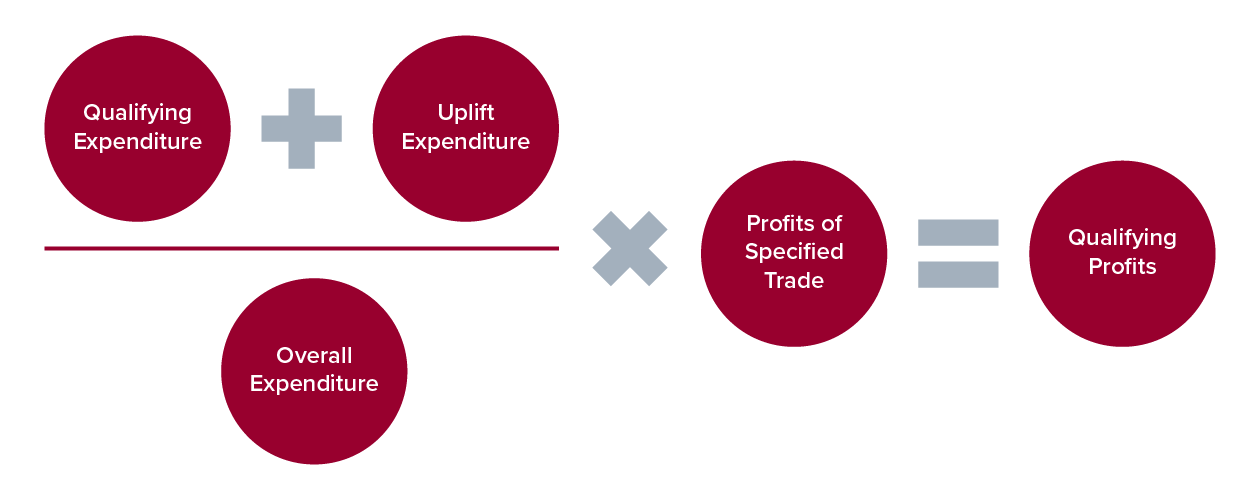

The Knowledge Development Box (“KDB”) is a corporation tax relief on income from qualifying assets. The KDB offers the opportunity for an effective tax rate of 6.25% on qualifying profits generated in periods commencing on or after 1 January 2016. The relief available is linked to the percentage of qualifying R&D expenditure incurred in Ireland.

There are links between the KDB and the R&D tax credit, and therefore companies already claiming the R&D tax credit should examine their eligibility and the potential benefits of also access the KDB regime.

What intellectual property ("IP") qualifies for the KDB?

A Qualifying Asset is IP, aside from marketing-related IP, which is the result of R&D activities. The definition of IP includes:

**This criterion is specifically applicable to certain SME’s. Please contact us for more information.

In order to qualify for the regime the first thing that should be considered in whether or not the company has or is capable of creating qualifying assets, and in turn whether those qualifying assets are part of a profitable trade.

There is also scope to link assets and create a “family of assets” where it can be demonstrated that there is significant commonality of scientific, technological or engineering challenges underlying the associated R&D.

Where a company has qualifying assets for KDB purposes, the qualifying income from those assets will include royalties and licence fees. Also, where the price of a product or service includes an amount which is attributable to a qualifying asset, a portion of the income from those sales can qualify (i.e. embedded IP scenarios).

Eligibility Assessment

The assessment tool should provide you with a high level indication of:

This tool is a high level calculator and will not result in a figure that is sufficiently accurate to be relied upon or included in any tax return.

The qualifying profits are halved by way of a 50% tax deduction in order to give effect to the 6.25% rate on those profits.

Mark O'Sullivan