Contributor: Carol Lynch, Partner and Head of Customs & International Trade Services, BDO

The biggest mistake Irish businesses can make right now is assuming the geo-political trade landscape with its increase in tariffs, controls and protectionism will be temporary.

I think we can safely say we are in a new era where tariffs or the threat of tariffs will be commonplace. President Trump has shown he is willing to extend US tariffs on any and all imports to underpin his “America First” policy. This has involved a number of changes along the way, and we are currently in a “temporary pause” of sorts, in relation to escalating reciprocal tariffs.

Notwithstanding this, along with the Universal 10% base rate, there are also:

- Sectoral tariffs on Automotives along with Steel and Aluminium and derivatives at 25%

- Canada and Mexico Tariffs at 25% outside the Free Trade Agreement (USMCA)

- China tariffs

- Tariffs due on automotive parts and potentially coming on Pharmaceuticals among other things.

And on the other hand

- Exceptions to the Universal Tariffs as laid out by Annex 2 to the April 2 Executive Order

- A temporary reprieve from the highest tariff rate for Smart Phones and Computers from China

And ones to watch in the coming weeks to months are proposals for tariffs on:

- Pharmaceuticals, and

- Semiconductors

In reaction the EU remains in the “compromise and negotiate” phase. However, the EU Commission have also confirmed they will act “firmly and immediately” as required. Alongside this the focus will be on increasing and strengthening Free Trade Agreements.

However, this is fast moving and, at the time of printing, may well have changed.

We now see this i.e. tariffs or the risk of tariffs, as something companies will have to manage over the coming year.

Companies should therefore start pro-actively planning for these potential cost disruptions and act accordingly. Below we have listed where things stand right now and our advice to clients.

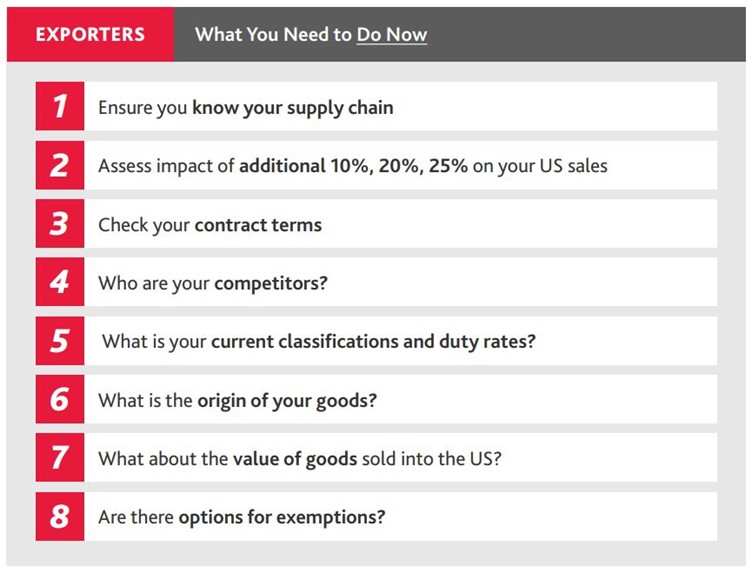

What should Irish Exporters do at this point?

Irish Exporters need to complete a risk analysis and assess the cost to profits or sales from the current additional 10% minimum charge along with relevant sectoral tariffs and a potential increase to a 20% reciprocal tariff after the 90-day reprieve.

We also advise to ensure you are familiar with the Annex 2 exceptions.

If you are impacted by the new duty rates, then strategic customs planning should be undertaken.

Firstly look at your tariff classifications. Note that the TARIC/CN codes we use in the EU will not necessarily be the same at the 8 or 10 digit level as they would be in the USA - so classifications need to be considered in the context of the HTSUS as opposed to TARIC (i.e. the EU tariff schedule).

President Trump has also been very clear that the focus of the US authorities will be on confirming the tariff classification of the imported products. This will ensure no avoidance and will capture as many products as possible.

Expect therefore a robust position by US Customs on Tariff Classification.

Secondly assess the origin of your goods – are they EU originating products under the Rules of Origin.

Thirdly look at your pricing – is there an opportunity to reduce the value for customs purposes? This is a complicated area and requires input from both Transfer Pricing and Customs Professionals.

The US also operates a procedure known as “First Sale for Export” which allows the price of the original sale to be declared for Customs purposes subject to very strict rules. For example, one condition is that you must be able to show the original sale was specifically for the US market. This can be very beneficial but requires very technical customs advice.

We recommend the following steps as a checklist:

.jpg?lang=en-GB)

EU Retaliatory Tariffs

A second matter to take account of is EU retaliatory tariffs. These are to be introduced in two phases (now also paused for 90 days).

In all cases the counter-tariffs are designed to specifically counter-act the US measures on the specific products involved (steel, aluminium, aircraft) and to directly target products from Republican States.

The first list of products, which were due to come into effect April 15th essentially covered steel and aluminium along with products for retail such as jeans, cosmetics and tobacco.

The second wider list is still under consideration.

What to do now?

Based on this overview then, what would we recommend are 6 sensible and practical steps for companies to take for imports and exports?

- Firstly, check your contracts – who is acting as the Importer of Record responsible for the payment of the duties?

- Next what is the tariff classification of your products – will they fall into any of the lists above and can you make any adjustments to the products if needed?

- What is the origin of your products? – are they EU origin or US origin or alternatively can a different origin be applied?

- What is the extent of your purchases from the US and sales to the US? How will profits and costs be affected? How will pricing be affected? How resilient is this?

- Most of world trade takes place between Inter-Related parties therefore, if you are sending goods to your related parties in the US, how are these being valued? Have you looked at your transfer price? Similarly look at this for imports.

- Look at your value chain - can you extend sales to other countries dependant on the impact of these new trade wars and also can you take advantage of EU Trade

Agreements to increase your market access to 3rd countries e.g. agreements with Canada and Mexico?

Where are your non-EU purchases from? Will these be affected and do you need to ensure security of supply by looking at additional purchase options?

In our view it is always best to be prepared for worst case scenarios, and have accounted for risks, by taking sensible precautionary steps that can provide you with some control as we move forward into this more complicated trade landscape.

Content published in Finance Dublin Irish Tax Monitor.