Irish Tax Monitor - April: The new era of Tariffs

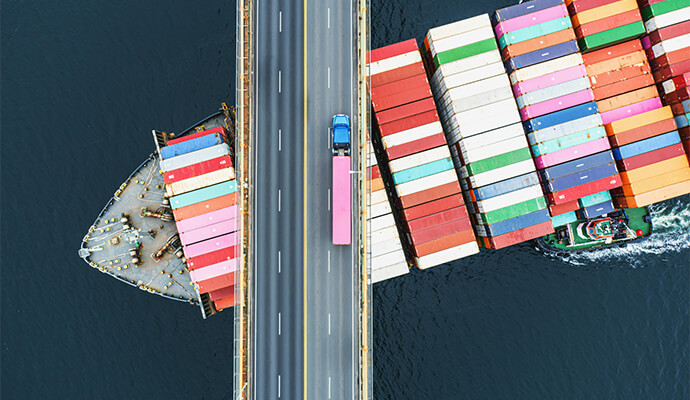

With tariffs now on the global agenda in a way not seen for almost a century, there are risk assessment processes that Irish multinational corporates should be undertaking. We are currently in a “temporary pause” of sorts, in relation to escalating reciprocal tariffs. However, action is still advised.

Irish Tax Monitor - March: High Court Susquehanna Case

The long anticipated High Court judgement in the Susquehanna case was given on the 2nd October 2024. Revenue denied the group relief claim on €46.6m of losses incurred in 2010/12. We explain the basis of this decision.

Indian Tax Developments impacting Irish Aircraft leasing entities

Indian tax authorities have increased their focus on Irish entities undertaking aircraft leasing to Indian entities, with notices issued to some aircraft leasing companies, questioning the eligibility under the India-Ireland treaty.