An extensive financial model is a fundamental tool for any business. We have broad experience of building financial models for business planning as well as transactions. The models we build can serve a dual purpose being both relevant to a particular transaction and to be used as a management forecasting tool. By providing our clients with high quality models, we help them make better, more informed decisions involving operations, transactions, and funding, among others.

Financial models can be confusing. We plan our models to be easy to explore, adaptable and customised to your necessities. They will give you the certainty that you are making informed choices and that you completely understand their effect.

What we do

Our combined experience of financial modelling and valuations means there are no situations that we have not encountered before. You can be sure we understand what is required and what is at stake for our client.

Our experienced team have successfully performed numerous assignments across various sectors and have worked on all types of engagements.

Our modelling experience includes:

Operational and business planning | Cashflow management | Scenario and sensitivity analysis |

| IPOs | LBO/MBOs | Private equity |

Growth and acquisitions | Debt and refinancing | Project finance |

Portfolio analysis | Fund modelling | Valuations |

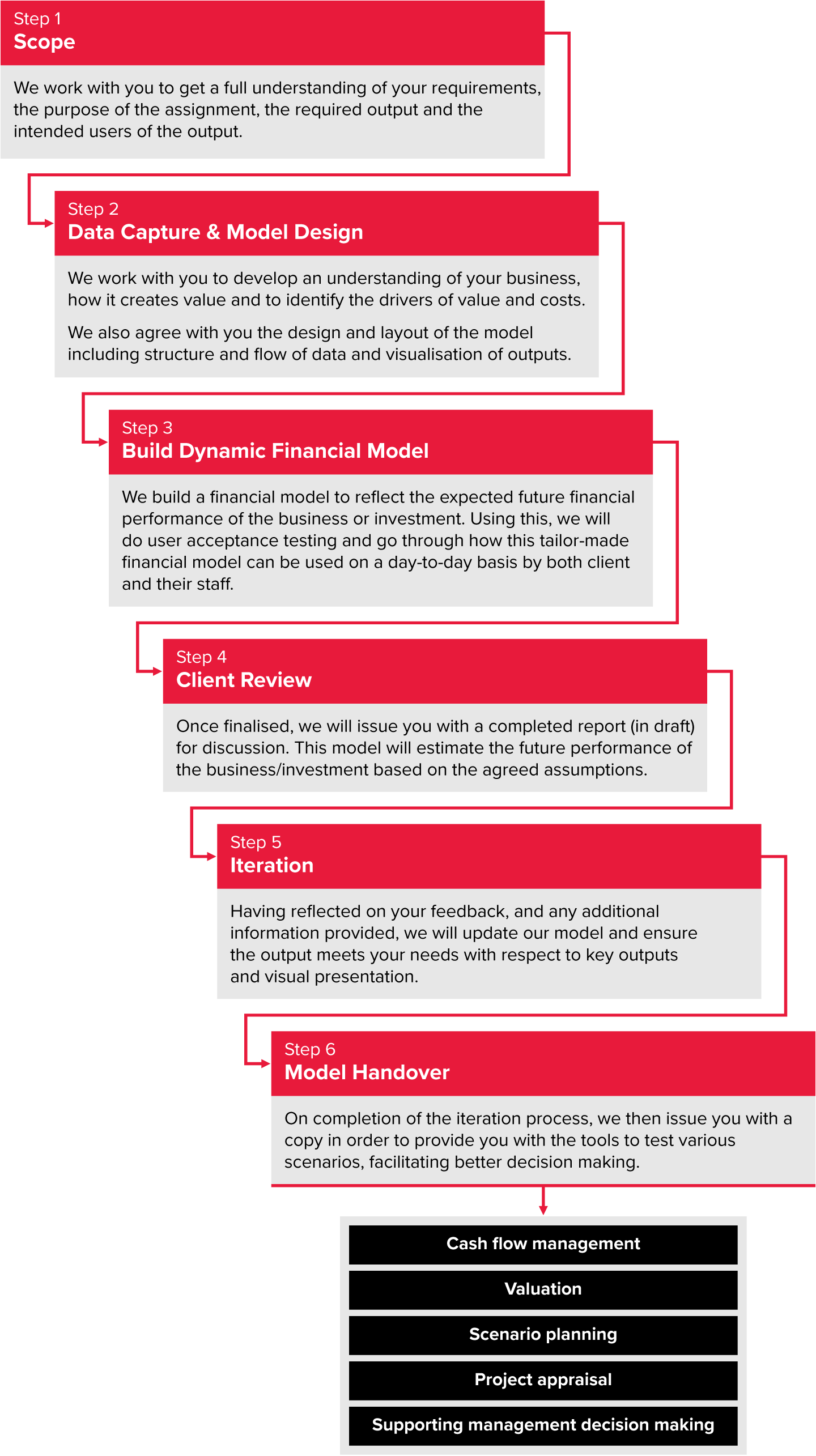

Our approach: