BDO’s Valuation team delivers independent valuations for a variety of purposes. Our valuation work is varied and includes reports needed to comply with accounting or regulatory standards and for tax, litigation, family, or commercial purposes.

In our experience, a valuation is often needed at a difficult or stressful time. This may be a shareholder dispute, a potential sale, the breakdown of a relationship or simply the year-end audit process. We provide an efficient valuation service that gives our clients the confidence of having the full picture.

What we do

We provide tailor-made financial modelling solutions. Regardless of which sector you are operating in, we have significant expertise and knowledge to suit your specific needs. We deliver valuations in a timely and cost-effective way to support our clients' stategic decisions.

You can expect more from our team. We go beyond giving a valuation opinion by identifying key drivers of value for a prospective buyer.

Our modelling experience includes:

- Project appraisal

- IFRS/Tax compliance

- M&A

- Fundraising

- Purchase price allocation.

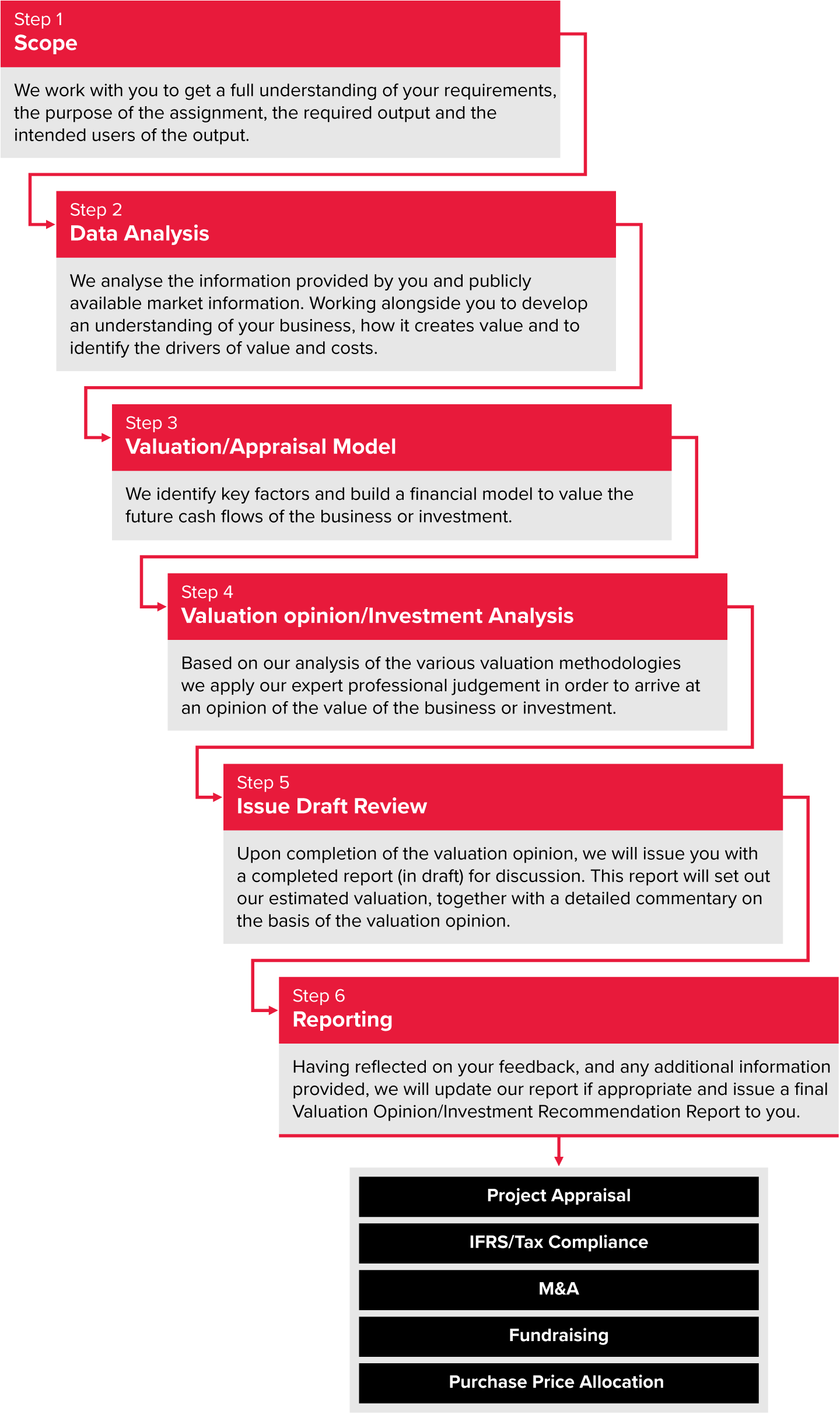

Our approach