Mark O'Sullivan

Exploring R&D tax credits and innovation grants in Ireland is a strategic way for organisations to drive innovation, reduce costs, and increase profitability. With the R&D tax credit rate currently at 30%* and grant funding covering up to 50% or more of eligible research and development expenditure, these incentives can reduce the cost of innovation by a third or more.

These supports provide far more than funding—they enable a sustainable innovation pipeline, stronger competitiveness, and faster business growth. Whether you are a start-up, SME, or multinational, there are tailored R&D tax credit and grant funding options across all sectors, from technology and life sciences to manufacturing and food & drink.

Now is the time to assess your eligibility, plan your innovation funding strategy, and maximise the value of Ireland’s R&D incentives for your business.

*R&D Tax Credits are rising to 35% for accounting periods commencing on or after 1st January 2026.

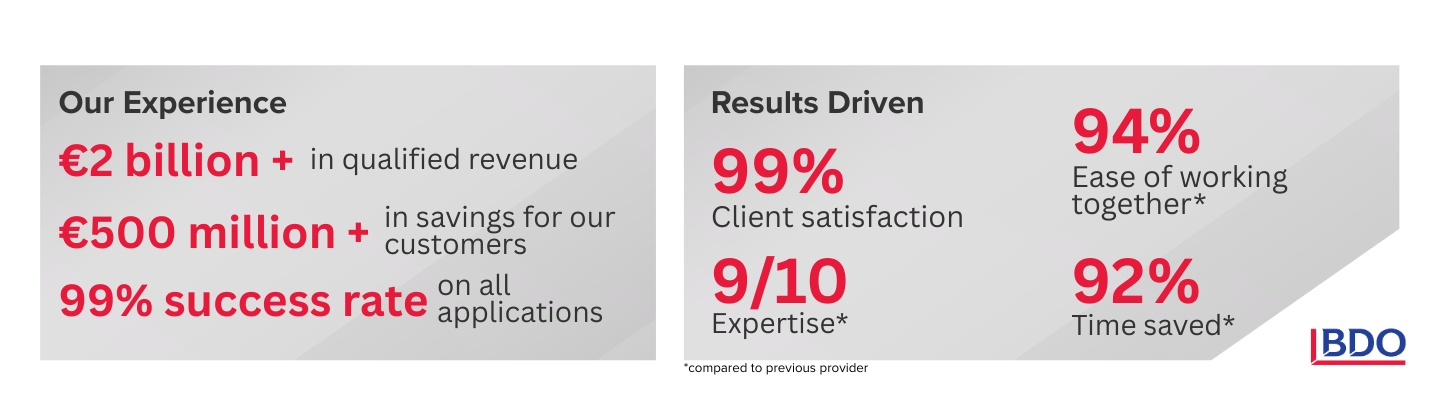

BDO’s R&D Tax Credits and Grants team brings together Ireland’s first engineer-led R&D incentives practice with global expertise across more than 500 specialists. Our multidisciplinary team—spanning engineering, science, technology, and tax—ensures every eligible activity and cost is captured, documented, and maximised.

With decades of experience, a proven 99%+ success rate, and one of the country’s strongest Revenue audit records, we help clients secure R&D incentives with confidence and minimal disruption. Our focus: precision, process efficiency, and measurable results.

Discover the supports available across Ireland’s R&D landscape, from tax credits and grants to knowledge development and digital innovation. Scroll or use the arrows below to explore each area in more detail.

Mark O'Sullivan