Banking & Alternative Finance

In the dynamic landscape of financial services, both banks and alternative finance institutions play pivotal roles in driving economic growth. Complexities and challenges inherent in this industry include navigating the intricate regulatory environment, optimising operational efficiency, and ensuring sustained financial health.

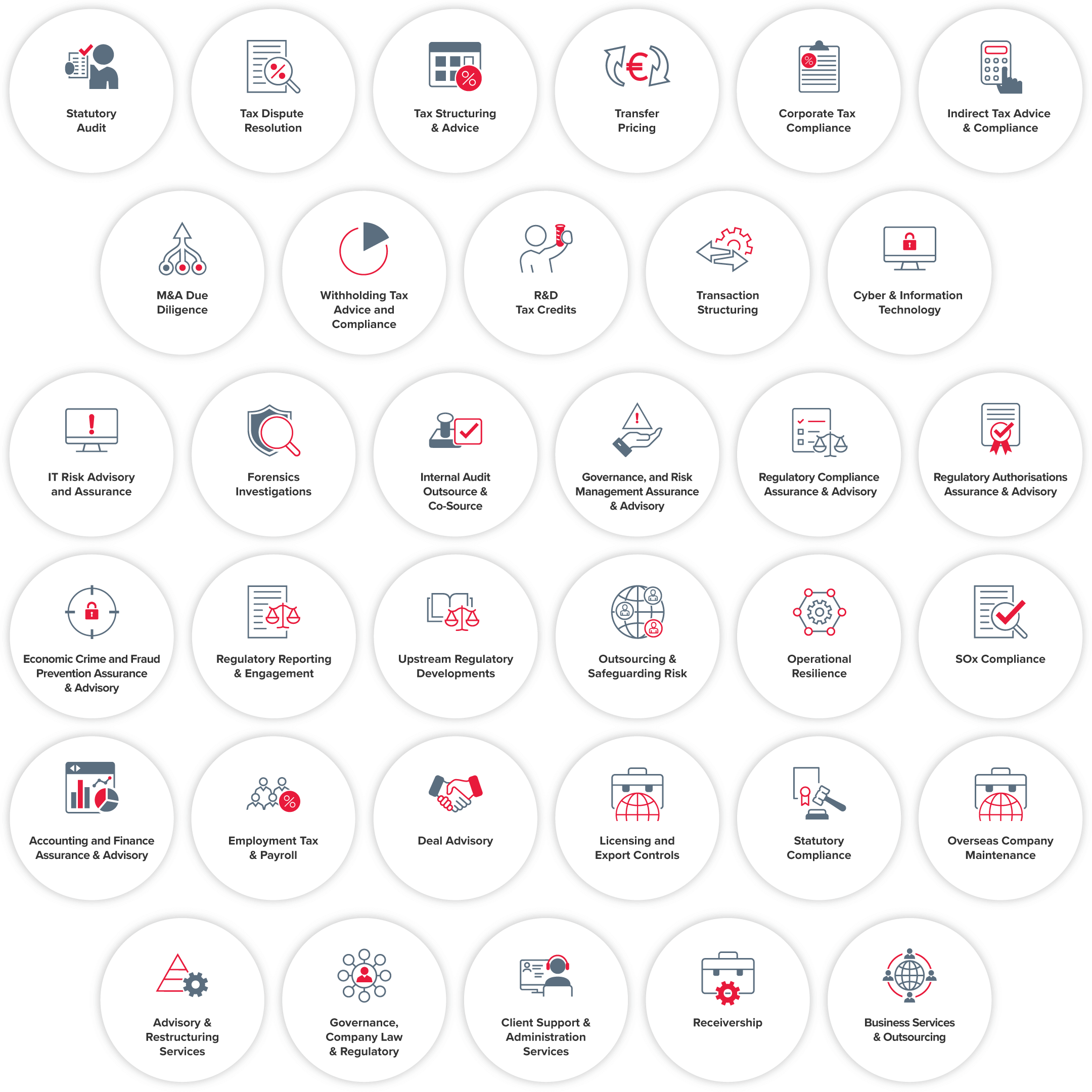

Our dedicated team of experts offers comprehensive solutions ranging from external and internal audit, risk management and compliance, to strategic planning and technology integration. With a client-centric approach focused on finding solutions, at BDO, we are committed to fostering the success of banks and alternative finance providers by delivering insightful solutions that align with your specific needs, thereby enabling you to thrive in an ever-evolving financial landscape.