Corporate Service Providers

Corporate Service Providers (CSPs) are vital partners for businesses expanding into new markets or seeking to streamline their operations. CSPs offer essential services to ensure regulatory compliance and operational efficiency. Despite challenges such as evolving regulations and increased competition, CSPs play a pivotal role in supporting businesses.

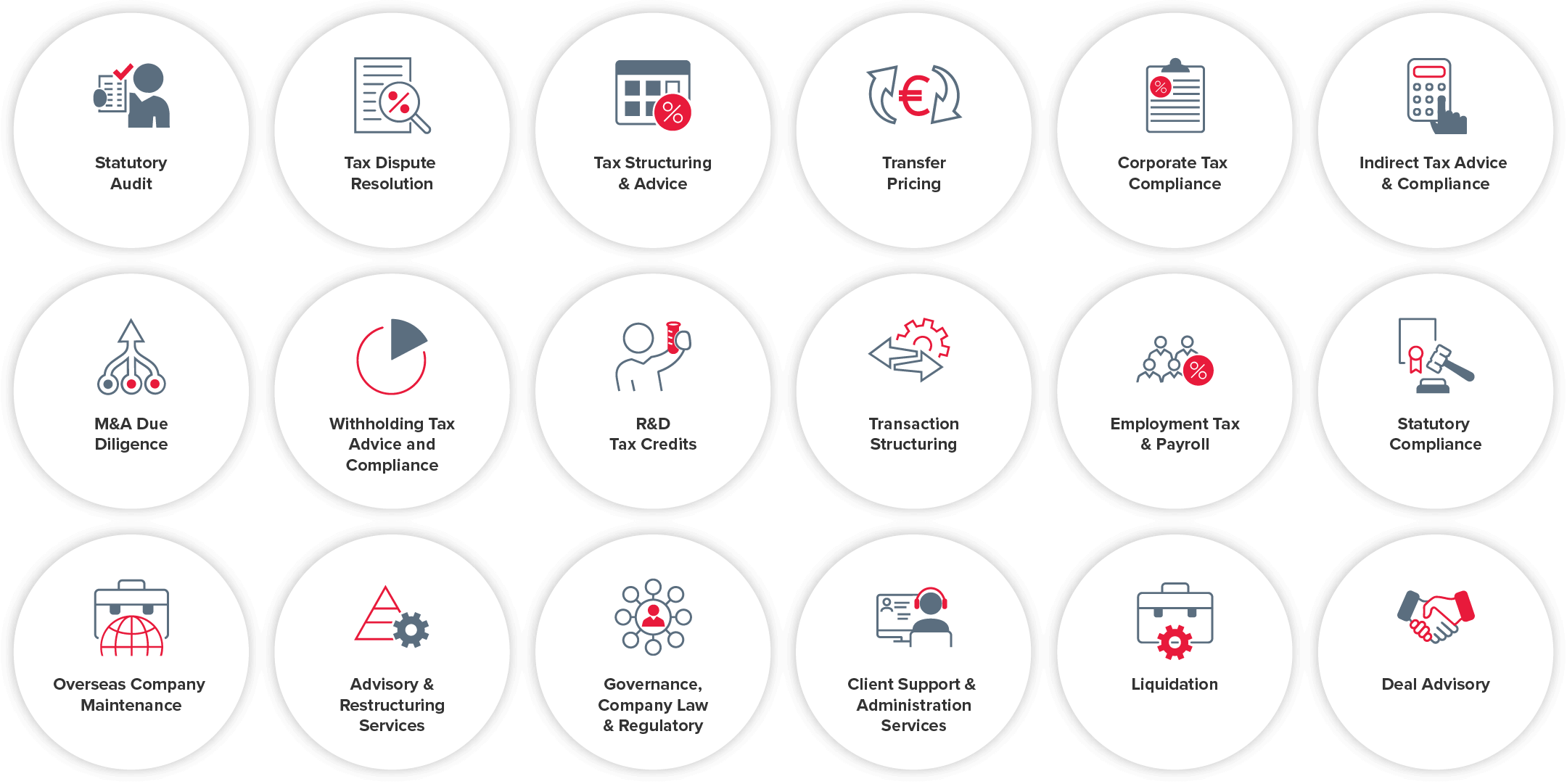

At BDO, we understand the diverse needs of CSPs and provide tailored solutions, from tax structuring to cybersecurity, empowering CSPs to navigate regulatory complexities confidently and deliver exceptional value to clients. Partner with BDO to optimise your CSP business and thrive in today's dynamic business landscape.

.jpg.aspx?lang=en-GB&width=362&height=259&ext=.jpg)