Sinéad Heaney

BDO operates a joint venture, BES Management DAC with Davy which manages the Davy EIIS Funds.

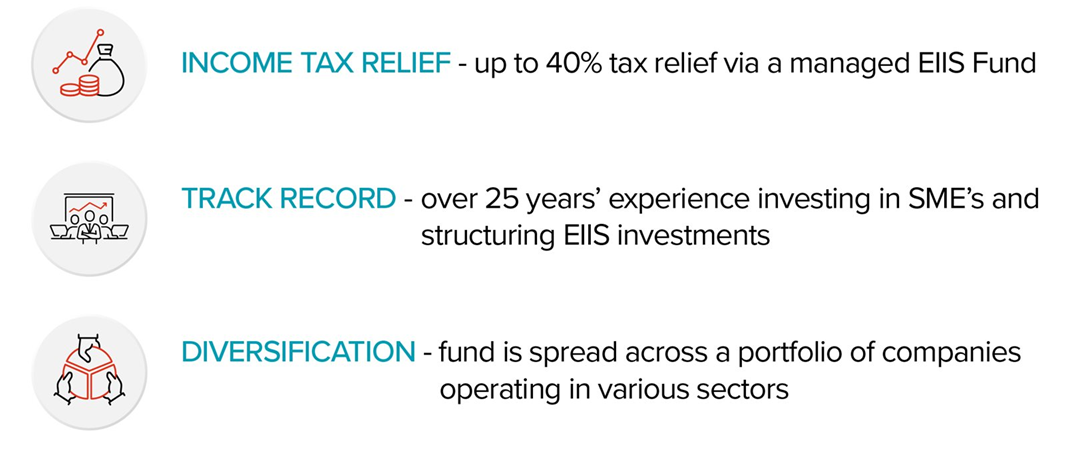

BES Management DAC is Ireland’s longest running and most experienced BES/EIIS Fund manager. We have successfully raised and invested over €200m in BES and EIIS funding over the past 25 years.

We invest EIIS funding in Irish SMEs to support ambitious management teams to achieve their growth plans.

The Employment and Investment Incentive Scheme (EIIS) is a tax relief scheme which offers individual investors tax relief of up to 40% as an incentive to encourage investment in small and medium sized companies in Ireland.

BES Management Designated Activity Company is regulated by the Central Bank of Ireland. BES Management DAC. is a joint venture company owned by Davy and BDO. J&E Davy, trading as Davy, is regulated by the Central Bank of Ireland.

BES Management DAC are currently actively seeking investment opportunities that meet our Davy EIIS Fund Mandate set out below.

BES Management DAC’s Davy EIIS Funds invest in Irish SME’s and are sector agnostic. We have completed investments in all 26 counties and across all sectors.

As an investor, we align with management teams to support them to achieve their growth plans. We bring our experience and market knowledge to assist and accelerate the growth potential of our investees.

Sinéad Heaney

Andrew Bourg

Patrick Morrissey

David McCormick